WHAT TO DO WITH ALL THAT MONEY

Posters Encouraging U.S. Citizens to Buy Savings

Bonds: 1945 and 1975

Unit

Overview

Now

that you know what money is, what can you do with it? In reality, people have two options when it

comes to money. They can spend it, or

they can save it. By saving it,

individuals make funds available for others to borrow it. Companies, for example, can use these loans

to expand production, while savers can receive profits through interest and

dividends. This exchange makes economic

growth possible, but, as with all decisions, it comes with trade-offs. Let's see how it all works.

How an

Economist Defines Savings

Economists

define saving as the absence of spending.

In other words, if one is not spending, he or she is saving. The money that accumulates from this lack of

spending is called savings, and it is

essential for economic growth in a market economy. For businesses to supply the goods and

services that people need and want, they must have, along with the other

factors of production, capital. This

includes machinery, equipment, tools and money.

When people deposit money in savings accounts, banks are able to make

loans to businesses. Then, entrepreneurs

have the funds that they need to create new businesses and to update old

ones. Firms also have the financial

means to develop advanced technology, to purchase new equipment and to create

more jobs. For a saver, this becomes an investment, or the use of assets to

earn profits. The profit that the saver

makes above and beyond the initial investment is called a return. All investments come

with a certain amount of risk. An economist

defines risk as the chance that the

actual return will differ from the expected return.

![]() Go to Questions 1 through 3.

Go to Questions 1 through 3.

The

Financial System

If

investments are going to take place, an economy must have a financial system that permits savers to

transfer money to borrowers. People can

house their savings in a number of locations.

Some may choose to open traditional savings accounts; others may

purchase certificates of deposit or bonds.

In each of these instances, the saver receives a document, such as a

passbook, certificate or computer printout, to confirm that the transaction has

taken place. In the event that the

borrower does not pay back the loan, these records provide legal proof that an

individual, business, or government has borrowed a specific amount of money

that must be repaid.

Although

savers and borrowers sometimes interact directly, they often connect through

financial institutions referred to as intermediaries. Financial intermediaries help direct funds

from savers to borrowers. The table below offers several examples:

|

Financial

Intermediaries |

|

|

Banks,

Savings and Loan Associations and Credit Unions |

These institutions receive deposits from savers. Then, they lend some of these funds to individuals

and businesses. |

|

Finance

companies |

Finance companies make loans to small businesses and

individuals, including clients who have a history of not repaying loans. To cover any losses that may result,

finance companies charge borrowers higher interest rates. |

|

Mutual

funds |

Mutual funds combine the savings of many clients and

invest their money in a variety of bonds, stocks and business ventures. This decreases the risk for savers because

they are not investing in just one company. |

|

Life

insurance companies |

Life insurance companies sell policies that provide financial

protection for families when policyholders die. They lend part of the payments, or premiums, that they collect for this

service to borrowers. |

|

Pension

funds |

Many retirees receive payments called pensions after they work a certain number of years, reach a

certain age or are injured on the job.

Employers often withhold a percentage of workers' salaries for this

purpose and sometimes contribute to these funds on behalf of their employees. Pension fund managers make some of this

money available to borrowers. |

Although

it may seem that savers and borrowers could simplify the process by dealing

with each other directly, there are advantages to working through

intermediaries. Intermediaries help savers to decrease risk by putting their

money to work in a variety of ways. This

strategy of spreading out investments is known as diversification. It reduces the possibility of losing everything if

a single investment fails. On another

front, most savers and borrowers do not have the time or the resources to

research investment opportunities on their own. Because intermediaries collect

and monitor financial data, they are valuable sources of information. The law requires intermediaries to publish

this material in an annual report called a prospectus. Intermediaries also provide savers with liquidity, or the ability to convert

their investment to cash. Let's say that

you decide to invest in a mutual fund.

After keeping the investment for three years, you want to sell it so you

can use the money to buy a car. You can

easily do that. However, suppose you had

purchased several collectable sports cards instead. This would be more difficult to convert to

cash because you would have to find another investor who would buy the cards.

![]() Go to Questions 4 through 7.

Go to Questions 4 through 7.

Saving

Accounts

Banks

offer a variety of options for savers. Traditional savings accounts are the most

common and are easily opened in person or online. They are especially useful for customers who

tend to make frequent withdrawals.

Because there is no penalty for taking money out of the account, they

are excellent places to store money for emergency purposes. Savings accounts are safe even if the bank

fails because they are insured by the Federal

Deposit Insurance Corporation (FDIC).

However, they only pay a small amount of interest at an annual

rate.

Federal Deposit Insurance

Corporation: Arlington, Virginia

Money market savings accounts pose another

alternative for savers. Because they are

also federally insured, this option qualifies as low risk and pays higher

interest rates in comparison to traditional savings accounts. However, interest rates for this type of

savings program are not fixed but may move up or down depending on economic conditions. They generally require a minimum balance, or a specific amount of money maintained in the

account at all times. The financial

institution also limits the number of withdrawals that a saver can make. Certificates

of deposit, commonly known as CDs, also pay higher interest rates and are

federally insured. Unlike money market

savings accounts, they offer a guaranteed interest rate for a certain number of

years. During that time, the saver may

not withdraw funds from the account without paying a penalty. In other words, the saver gives up immediate

liquidity for a higher return. Money

market accounts and certificates of deposit work well for savers who are

storing money for the long term. The

video listed below explains several things to consider when opening a savings

account.

![]() Go to Questions 8 through 10.

Go to Questions 8 through 10.

Bonds

Sometimes

corporations and governments need to borrow money to finance major projects for

long periods of time. For this reason,

they often issue bonds. A bond represents a loan that a government or

company must repay to its investors.

Bonds usually pay investors stated amounts of interest at regular intervals

for the duration of the loan. Bonds have

three basic features: coupon rate,

maturity and par value. The coupon rate refers to the amount of

interest that the issuer of the bond agrees to pay the lender. The time when the repayment of the loan

itself is due is known as the bond's maturity. The par

value is the amount borrowed, or the principal,

that must be repaid to the lender upon maturity. For example, a corporation sells a $2,000 par

value bond for twenty years at 5% interest paid twice a year. The bond's holder receives $50.00 twice a year

(.05 times 2,000 divided by 2). After

twenty years, the company pays off the debt by giving the holder of the bond the

initial investment of $2,000. The video

listed below explains more about how bonds work.

Although

this may appear to be a good way to profit from saved money, not all

corporations and governments are equal in credit-worthiness and financial

health. Unlike savings accounts, bonds

are not insured, and there are no guarantees that the borrower will still be in

existence when the bond matures. How do

investors know which bonds are "good" and which ones are "not so good"? Fortunately, investors can rely on the

research and analysis of two major companies.

Standard & Poor's and Moody's rate bonds on several

factors. They consider the issuer's past

credit history, its ability to cover the interest payments and the likelihood

that it can repay the principal. Bond

ratings, listed in the graphic below, range from AAA (Aaa on the Moody's scale)

to D. Those listed as BB and Ba or lower

are generally the riskiest types of bonds.

At this end of the scale, there is valid information to show that the

interest and/or principal is less likely to be repaid when compared to those

bonds at the top of the scale. Nonetheless,

many bonds are considered reasonably safe investments.

|

Bond Classifications |

|||

|

Standard & Poor's |

Moody's |

||

|

AAA |

Highest Grade |

Aaa |

Best Quality |

|

AA |

High Grade |

Aa |

High Quality |

|

A |

Upper Medium Grade |

A |

Upper Medium Grade |

|

BBB |

Medium Grade |

Baa |

Medium Grade |

|

BB |

Lower Medium Grade |

Ba |

Speculative Elements |

|

B |

Speculative |

B |

Generally Not Desirable |

|

CCC |

Vulnerable to Default |

Caa |

Poor, Possibly in Default |

|

CC |

Other Debt Rated CCC |

Ca |

Often in default |

|

C |

Other Debt Rated CC |

C |

Bonds Not Paying Income (Interest) |

|

D |

Bond in Default |

D |

Interest and Principal Payments in

Default |

Investors

can choose from several different types of bonds, such as the ones listed

below. However, they must keep in mind

that rewards involve trade-offs. As the

potential for higher returns increases, the amount of risk also increases.

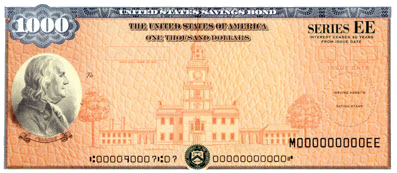

Ø Savings Bonds:

Savings bonds are issued by the federal government and have virtually no

risk of default, or failure to repay

the debt. They come in small

denominations ranging from $100 to $10,000.

The money raised from their sales pays for public projects like monuments,

bridges and national parks. Unlike other

bonds, the U.S. government does not issue payments to bond holders at regular

intervals. The buyer purchases the bond

for less than par value instead. For

example, an investor can buy a $100 savings bond for $50. When it matures, the bondholder receives $50

as repayment for the principal and $50.00 in interest.

An Example of a United States Savings Bond

Ø Treasury Bonds, Bills and Notes: Treasury bonds, bills (T-bills) and notes

(T-notes) represent other opportunities to invest through the United States

Treasury Department. Investors can

purchase them for a minimum of $1000.

Because they are backed by the federal government, there is little risk

to the investor. Treasury bonds are

considered long-term investments because they mature anywhere from ten to

thirty years. Since they reach their

value in two to ten years, economists regard T-notes as intermediate-term

investments. On the other hand, T-bills

mature in three to twelve months and are labeled as short-term investments. To learn more about bonds issued by the

federal government, click on the icon below.

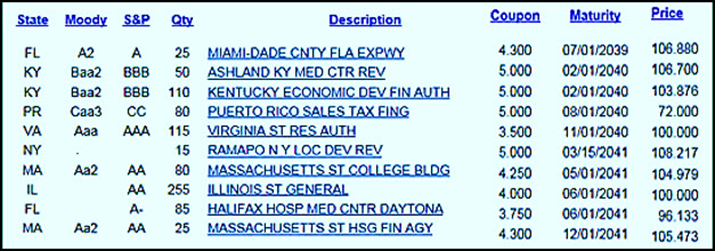

Ø Municipal Bonds:

State and local governments also sell bonds to fund new schools, to

improve roads and to complete other public works. These are referred to as municipal bonds, or munis. Standard and Poor's and Moody's classify

these as reasonably safe investments.

This is based on the fact that state and local governments have the

authority to collect taxes. Therefore,

these governments are likely to keep up with interest payments and to repay the

loan when it matures. Any interest on

these bonds is not considered taxable income, and this is an added bonus for

investors. The graphic below shows a

list of municipal bonds for sale along with their ratings, the number

available, the coupon, maturity and price.

Information Courtesy of fms,bonds inc.

Ø Corporate Bonds:

Corporations sometimes raise money by issuing bonds. Unlike governments, they have no tax base to

help guarantee repayment. Corporations

depend on their profits from sales of goods and services to repay their debts. Sales, however, may not increase as anticipated. For this reason, most corporate bonds have

moderate potential for risk. Bondholders

also pay income tax on any interest payments that they receive. To eliminate

fraud and other dishonest practices, the Securities

and Exchange Commission (SEC), an independent agency of the federal

government, carefully monitors companies that borrow money by offering bonds.

The United

States Securities and Exchange Commission:

Washington D.C.

Ø Junk Bonds: In

the 1980s and 1990s, junk bonds became a popular option for aggressive

investors. Investors purchase these low-rated bonds because the corporations

that issue them are willing to pay higher interest rates to borrow money. They have the potential to produce a much

higher return than federal, municipal or corporate bonds. However, there is also reason to believe that

the company issuing these bonds will default, and the bondholder will lose his

or her investment.

![]() Go to Questions 11

through 22.

Go to Questions 11

through 22.

what

What

Happens next?

Bonds

represent one way that corporations raise money to produce goods and

services. They may also choose to sell

shares of stock in their businesses.

This not only provides cash to start, maintain and expand production but

also gives investors an opportunity to make a profit. As with all investments, however, buying stock

comes with risk. Before exploring this

topic in the next unit, review the terms found in Unit 10; then, answer

Questions 23 through 32.

![]() Go to Questions 23

through 32.

Go to Questions 23

through 32.

|

| Unit 10 Main Points Worksheet |

| Unit 10 Crossword: What To Do With All That Money |