COMPETITION AND THE MARKETPLACE

The Mall: One

of the markets where buyers meet sellers

Unit

Overview

One

of the most important characteristics of a market economy is competition. In markets, producers compete with each other

to meet demand and to make profits. At

the same time, consumers compete for goods and services at prices that they are

willing and able to pay. The degree of

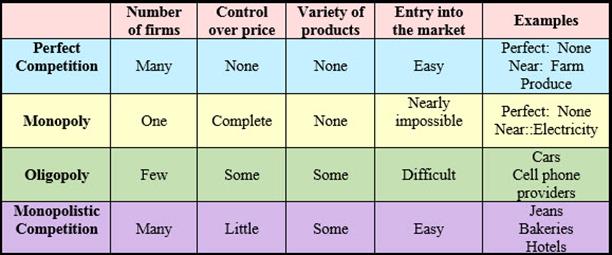

competition among rival firms has led economists to divide market structures

into four major categories: perfect

competition, monopoly, oligopoly and monopolistic competition. Let's see how it all works.

The

Invisible Hand

According

to most economists, one of the key elements in keeping a market economy

functioning smoothly is competition. One of the first people to explain the

importance of this characteristic was Adam

Smith, a Scottish philosophy professor. In his book titled The

Wealth of Nations, Smith emphasizes that a country's economy works best

and acquires its greatest wealth when individuals are free to pursue their own

self-interests without government interference.

While he notes that government should protect private property and

enforce contracts, Smith stresses that it should not attempt to control prices

or to bailout failing businesses. This

philosophy is called laissez-faire, a French term which

means let them do as they please.

According

to Adam Smith, self-interest acts as an invisible

hand that guides the decision-making process of producers and

consumers. This leads to choices which make

the best use of scarce resources. With

the goal of making a profit, producers become rivals and challenge one another

to meet consumer demand. The competition

heats up when sellers employ tactics, such as advertising, offering promotions

and producing more efficiently. As profits convince sellers to create more of

what buyers are willing and able to purchase, competition among sellers

encourages new businesses to enter the market.

This increases supply, improves quality and eventually lowers

prices. Consumers also compete against

each other in the marketplace. Competition

among buyers impacts demand and, in turn, prices. It also allocates goods and services among the

people who are most able to pay for them. All of this is best accomplished

without laws or government regulation.

Remember—if left alone, the market will reach equilibrium. Smith's ideas

became the foundation of many European economies and continue to provide the

financial principles of countries around the globe today.

![]() Go to Questions 1

through 3.

Go to Questions 1

through 3.

Market

Structures

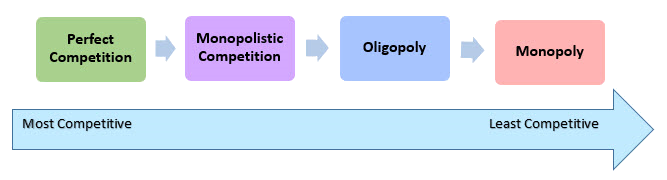

When

Adam Smith published The Wealth of

Nations in 1776, businesses were competitive because most factories were

small. By the end of the nineteenth

century, however, conditions had changed.

Many small firms had combined to form large companies through

acquisitions and mergers. This resulted

in the rise of industries that weakened the power of competition and created

markets that were dominated by a few, influential firms. Economists use the term industry to represent all

of the producers of an identical or similar good or service. For example, the U.S. steel industry refers

to all companies that manufacture steel in the United States. Today, economists group industries into four,

major categories known as market structures.

They include perfect competition, monopoly, oligopoly and monopolistic

competition. An industry's market

structure depends on the number of businesses within the industry and the ways

that they compete in the market.

![]() Go to Questions 4

and 5.

Go to Questions 4

and 5.

Perfect

Competition

The

simplest market structure is called perfect,

or pure, competition. As you may

have guessed when you saw the word perfect,

it refers to a very small number of industries that come close to reflecting this

model. Although perfect competition is

more theoretical than realistic, it is used by economists to evaluate the other

market structures. The conditions listed

below must be present for a perfectly competitive market to exist:

Ř Large numbers of buyers and sellers: Perfect competition requires many buyers and

sellers for a particular good or service.

A large number of independent producers and consumers means that no

single company or individual is powerful enough to sway the total market supply

or the market price. It also makes it

more difficult for groups of buyers or sellers to control prices by working

together. The market itself determines

the price without any influence from individual producers or consumers. Perfectly competitive markets operate

efficiently. Because it keeps prices and

production costs low, perfect competition benefits producers and

consumers.

Ř Identical Products:

There

are no differences among the items sold by the various producers in a perfectly

competitive market. This is certainly

true of commodities, such as milk, fuel oil, notebook paper and sugar. A commodity

is a product that is basically the same regardless of who makes it. For example, if a grocer is buying cauliflower

to sell in his store, he or she has no interest in who grew it as long as every

farm is willing to deliver it for the same price. This is based on the simple fact that one

head of cauliflower is very much like another. The buyer chooses the cheapest

supplier for cauliflower and does not pay extra for an identical product from

one, particular farmer.

Milk: An Example of a Commodity

Ř Well-informed buyers and sellers: When a market is purely competitive, buyers

and sellers are knowledgeable about an industry's goods and services. This encourages both sides of the market to search

for the best deals possible. Information concerning prices, products and

technological improvements is readily available with no lag time. For example, if a company is planning on

implementing a new production technique to streamline its manufacturing

process, the news is made public immediately to benefit both producers and

consumers.

Ř Free entry and exit from the market: If one firm can keep other companies out of

the market, it can sell its product at a higher price. For this reason, producers must be able to

enter and exit a purely competitive market structure freely and easily. In other words, companies enter the market

when they can make money and leave when they cannot. This helps to keep prices low because new

firms take business away from older firms that do not keep their pricing

competitive. It also makes it more

difficult for a few large companies to dominate the market.

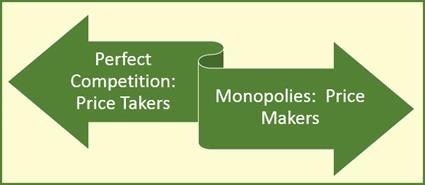

Just

like everything else, perfect competition has advantages and

disadvantages. In this situation, both

buyers and sellers are what economists call price takers. They accept,

or take, the market price. Since

producers in this market structure cannot control prices, there is little

opportunity to exploit the consumer.

This benefits buyers because they receive a standard-quality good or

service at a price determined by the market no matter where it is

purchased. At the same time, the system offers sellers

the advantage of spending little or no money on advertising. This is unnecessary since each firm's version

of the product is identical. However,

suppliers have little incentive to improve their products or to add new

features. If they charge more than the

market price, their customers are likely to shift their business to another

company. There is no reason to charge

less since firms can sell as much as they can produce at the market price.

![]() Go to Questions 6

through 10.

Go to Questions 6

through 10.

Monopoly

The

remaining market structures are all examples of imperfect competition. When

compared to perfect competition, a monopoly is at the opposite end of the

market structure spectrum. A monopoly

only has one seller for a particular good or service, but there may be any

number of buyers. As with perfect

competition, the U.S. economy offers few examples. This is because Americans have traditionally

disapproved of monopolies and have encouraged Congress to pass anti-trust

legislation opposing them. The

development of new technology also places limitations on monopolies. For example, email now competes with the U.S.

Postal Service, a federal agency that once was the sole supplier for mail

delivery.

In a

market structure controlled by a monopoly, there is one large firm supplying

the product rather than thousands of smaller ones. This gives the monopolist market power. Since there are no other sellers, a single

firm can raise prices without losing sales.

Although higher prices normally pull more sellers into the market, this

is only possible if producers can easily enter as they do in perfectly

competitive markets. However, monopolies

form because certain barriers make it difficult or impossible for new firms to

come into the market. Start-up costs,

the inability to obtain necessary natural resources and a lack of access to

technology discourage entrepreneurs.

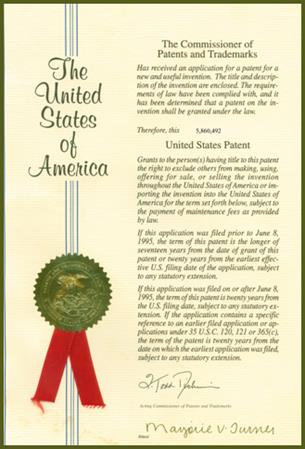

Licenses, patents, copyrights and franchises also keep some companies

out of the market. Without competition

and ease of entry, the seller in a monopoly becomes a price maker rather than a price taker.

Document

Issued by the United States Patent Office

Although

most people have a negative view of them, some monopolies do serve a constructive

purpose. This is true of natural monopolies. These are situations in which a good or a

service produced by a single firm actually lowers costs and promotes

efficiency. Public utilities fall into

this category. What would happen if more

than one company supplied water, natural gas or electricity to a small

area? In the case of electricity, each

company competing for customers would have to put up their own poles and lines.

Each firm providing water would have to run its own network of pipes. Because that would be wasteful and expensive,

utility companies often receive franchises,

or exclusive rights to do business in a specified area without

competition. Other beneficial monopolies

can be found in locations where sellers of similar products are not

present. This is known as a geographic monopoly. A single grocery store operating in a small town

that is unable to support other similar businesses is one example.

![]() Go to Questions 11 through 15.

Go to Questions 11 through 15.

Oligopoly

An oligopoly is a market structure in

which a few large sellers dominant an industry.

It is a little more competitive than a monopoly but much less

competitive than perfect competition. Economists

usually define an industry as an oligopoly if its four largest companies supply

between 70% and 80% of the total product.

Goods or services created by an oligopoly are often standardized

products like gasoline, but they may also be differentiated. Product

differentiation refers to the differences between two competing goods

within the same industry. These

variations may be real or, thanks to advertising, imaginary. Automobiles and smart phones are two

examples. Both offer products that serve

the same purpose but come in a wide variety of models, styles and brands. This category of market structures also

includes the soft-drink industry dominated by Coke and Pepsi as well as the

fast-food industry where McDonald's, Wendy's and Burger King maintain a large

percentage of the market.

Southwest Airlines: One of the

four carriers that dominate the U.S. airline industry

The

largest firms in an oligopoly tend to act as a team. Each of these companies knows that the others

have the power to affect price and to influence the choices made by

consumers. Therefore, whenever one

company raises its prices, the others soon follow. Because the companies within the oligopoly

act together when changing prices, firms tend to compete in areas other than

price. They do this through advertising

campaigns and by adding new features to their products. Although changes in price can be implemented

quickly, advertising gimmicks and product upgrades take more time to counteract

and put opposing firms at a disadvantage.

Within

an oligopoly, the major firms act as price makers and seldom protest the price

hikes of their rivals. When they choose

not to support a higher price, however, the company that initiated the increase

usually backs down to avoid losing customers.

Companies in oligopolies seldom lower prices. When they do, oligopolists may become caught

up in price wars in which firms slash

prices to draw more buyers. These brief

but intense clashes benefit consumers in the short-term. Overall, however, oligopolies result in

higher prices for buyers. As with

monopolies, patents, copyrights and licenses create barriers that make it

difficult for new firms to enter the market.

The

tendency of large firms within an oligopoly to work together sometimes leads to

illegal activities, such as collusion. Collusion is a formal agreement made by

firms to set prices and production levels.

Such arrangements often lead to price-fixing,

an action which commits companies to charge the same or similar price for a

product. These prices are almost always

higher than those determined through competition. Just as a monopoly does, this puts the

consumer at a disadvantage. The largest

firms in the oligopoly may also decide to divide the market among themselves,

an action that guarantees each of them a specific share and profit. Because collusion and price-fixing interferes

with free trade, the U.S. Congress has passed legislation to forbid these

practices. Nonetheless, some businesses

still risk engaging in these illegal activities for the sake of higher

profits.

![]() Go to Questions 16 through 19.

Go to Questions 16 through 19.

Monopolistic

Competition

In

several ways, monopolistic competition

resembles perfect competition. Both

market structures consist of large numbers of sellers. This limits the ability of an individual

producer or a small group of them to control price or supply of an

industry. The presence of many sellers

also prevents some companies from working together to shut others out of the

marketplace. As a result, firms can

enter or exit the market with relative ease.

There is, however, one major difference between perfect competition and

monopolistic competition. One criteria

for perfect competition is the sale of identical products. Monopolistic competitors, on the other hand,

try to convince consumers to pay for goods and services that are similar but

slightly different from those offered by other sellers. As an economist would say, monopolistic

competition relies on differentiated products rather than identical ones.

Folded Jeans Waiting for Buyers in a Monopolistic Market

Monopolistic

competitors focus on making sure that the buying public is aware of the unique aspects

of their product. They use coupons,

giveaways and advertising in their promotional campaigns. Think about the choices that you have when

buying a pair of jeans. All jeans are a

type of pants made from a version of denim, but stores stock a wide variety of

this piece of clothing at an equally wide variety of prices. What makes us pay $49.99 as opposed to $17.99

for something that is made from similar material and serves the same

purpose? Advertising convinces consumers

that a particular brand, store or restaurant is better than another. Unlike firms that engage in perfect

competition, companies operating in a monopolistic market structure are willing

to spend large sums of money to create a certain image or status for their

products.

Under

monopolistic competition, similar products usually sell within a narrow price

range. If a firm can convince the buying public that its brand is better, the company

can charge a higher price. If a company

cannot convince buyers that there are advantages to purchasing its brand, it

cannot charge as much. Although the

seller does have some leeway to raise and lower prices, this decision requires

caution. If producers raise the price

too much, consumers will lose interest.

Since most differences that separate a similar good or service from

another are minor, buyers will simply refuse to pay the extra cost and change

brands.

![]() Go to Questions 20 through 22.

Go to Questions 20 through 22.

What's

next?

Even

though economists maintain that a free enterprise economy works best without

government interference, the rise of large corporations in some markets has

limited the number of sellers. It has

also encouraged the formation of monopolies and oligopolies. To keep these market structures from controlling

price and supply, the federal government has used its authority to block

mergers and to prevent unfair competition.

As you will see in the next unit, this has had both intended and unintended

consequences. Before moving on, review

the terms found in this Unit 7; then, complete Questions 23 through 32.

![]() Go to Questions 23

through 32.

Go to Questions 23

through 32.

|

| Unit 7 Main Points Worksheet |

| Unit 7 Adam Smith |