BUDGETS & CIRCLE GRAPHS

Unit Overview

A budget is a plan used to balance your income and expenses. In this unit you will learn how to compute average incomes, make a budget, read and create circle graphs, and adjust a budget to comply with your needs.

Average Income and

Average Monthly Expenses

A personal budget, or plan to balance your income and expenses, can help you to plan and meet your monthly expenses.

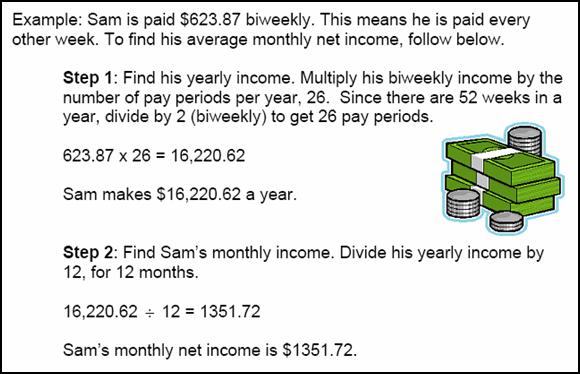

1. The first thing you want to do is compute the average monthly income available for your budget. You will do this by using only the net or take-home pay. This is the money you have left after taxes and other deductions. Net pay is the actual amount of money available for your budget.

2. After you have determined how much income is available, the next step is to decide what kinds of expenses or costs you will have.

3. Examples of expenses could be housing, food, clothing, insurance, entertainment, transportation, savings, and miscellaneous items.

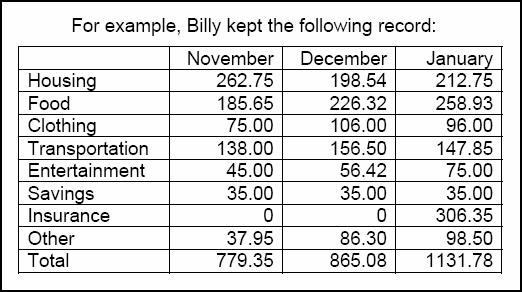

One way to determine your average monthly expenses is to keep a record of all your expenditures during a few months and then find the average amount you spend each month.

To find the average monthly expenses for Billy, add the totals from November, December, and January and then divide by three, because there are three months.

Billy’s average monthly expenses for the three months are $925.40.

By keeping track of all your expenses you will be able to anticipate how much you need each month.

|

|

Now go to the

questions section and answer questions 1 through 15. |

Making a Budget

Once you have listed all of your expenses, you are ready to make a budget. This budget will help you decide if you can afford optional purchases. A budget will also help you plan for vacations, new appliances, and other major expenses; and it can help you decide how to adjust your spending if you never seem to have enough money each month.

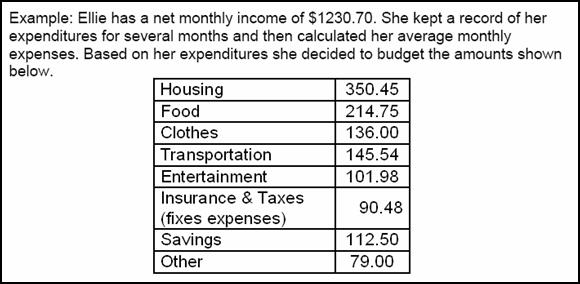

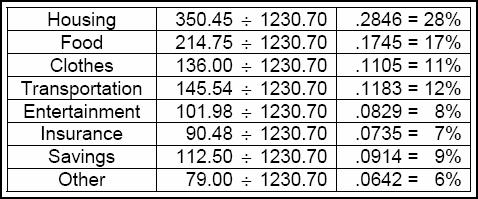

In order to easily compare a budget with other budgets, we will use percents to show the expenses. Refer to the example below.

We are going to develop a budget for Ellie by finding the percent of net income each budget item represents. To do this, divide the budget item expense by her net monthly income. Don’t forget you have to move the decimal point 2 places to the right when changing to a percent.

budget item

expense ÷ net

monthly income =

percent of budget

|

|

Now go to the

questions section and answer questions 16 through 19. |

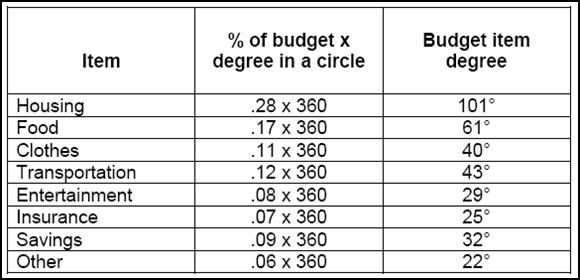

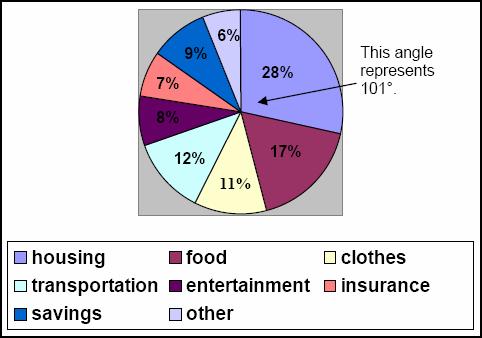

To picture Ellie’s budget on a circle graph and compare the amounts more easily, we have to first calculate the number of degrees (to the nearest degree) needed to construct a central angle for each section of the circle.

A circle is made up of 360°, therefore to determine the degree of the budget item, multiply the percent of the budget item by 360.

v

The reason the degrees do not add up to 360 is

because the percentages were rounded.

For the purposes of this unit, do not worry about drawing the circle graph. Computing the degrees of each percent is the important part of this unit.

Make and Create a

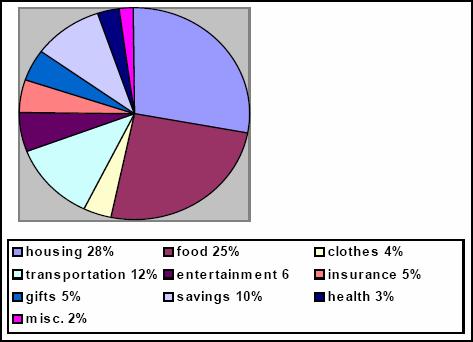

Circle Graph

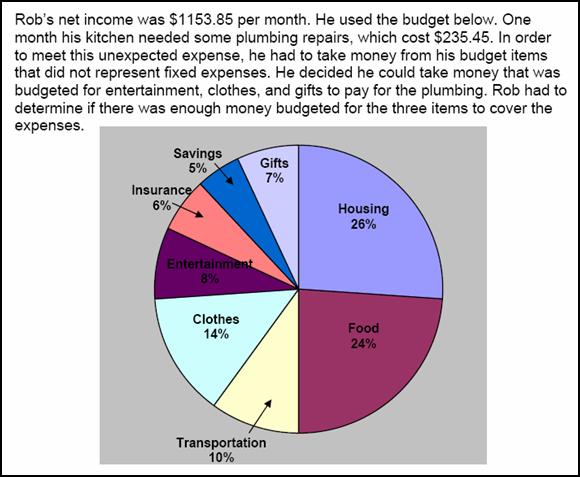

Another way to determine how much of your income you should use for expenses is by using a consumer group’s budget guideline. Such a guideline can be shown in a circle graph, or pie chart (shown below). Your income is divided into portions so that a certain amount of your money can be used for each expense. Dividing the circle into sections shows the relative size of each category.

It needs to be noted that expenses such as car and mortgage payments are called fixed expenses, or expenses that stay the same per month. Expenses that change from month to month, such as food, clothes, and recreation, are called variable expenses.

Adjusting/Balancing

a Budget

Balancing a budget means determining the state of finances after a given budget period. Sometimes it is necessary to adjust, or make changes to a budget. For example, you may receive a pay raise and want to add money to various expenditures. You may find out that there is not enough money available to cover unexpected expenses. Let’s follow the example below to determine if there is enough money budgeted for Rob’s plumbing repairs.

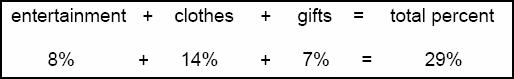

Step 1: Find the total percent for the three items.

Step 2: Find the amount of money budgeted for these three items.

Rob has $334.62 budgeted for these three items. He needs $235.45 for the plumbing. Therefore, he does have enough budgeted for the three items to cover the expense of the plumbing.

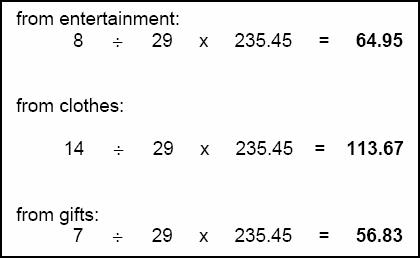

Next, we are going to determine how much Rob needs to take from each of the three items to pay for his plumbing repairs. To do this, follow the example below.

|

item percent |

÷ |

total percent |

x |

amount of unexpected repair |

= |

amount taken |

Rob must take $64.95 from entertainment, $113.67 from clothes, and $56.83 from gifts.

|

|

Now go to the

questions section and answer questions 20 through 49. |

|

| Unit 6 Where Does Your Money Go? Worksheet |

| Unit 6 Reworking a Budget Worksheet |

| Unit 6 Reworking a Budget Answer Key |