USING CREDIT WISELY

Unit Overview

In this unit, the student will learn about credit and making good credit choices.

Introduction

Carrie has just accepted a job and is excited to begin. There is only one problem; she needs a car to get to work and doesn’t have the money to buy one. So how does she solve her problem? Turn down the job? Get a friend to drive her to work? Get a loan to buy the car? If she chooses to get a loan, she is using credit.

Juan went to an oral surgeon to have his wisdom teeth removed. Later in the month he received a bill for the procedure. Juan is using credit.

Seamus borrows $5 from his friend for lunch. He says he will pay him back tomorrow. Seamus is using credit.

| When you owe money, you are using credit. When you buy something now and pay for it later, you are using credit. When you take out a loan to buy something, you are using credit. When you use a credit card to pay for a purchase, you are using credit. Credit can help you or it can bury you in debt. It is important to understand credit and make it work for you. |  |

Look over the following credit terms.

Principal - the amount of money borrowed.

Interest - the cost of borrowing money. Sometimes referred to as a finance charge, it is the money you pay the lender for allowing you to use money.

Interest Rate - a fee stated as a percent of the amount borrowed for a set period of time, usually one year.

Annual Percentage Rate (APR) - the total amount it costs to use a credit card for a year, usually stated as a percentage of the amount borrowed.

Balance - remaining or outstanding amount still to be paid.

Annual Fee - once a year charge made by the credit card company for the use of a credit card

Late Fee - a charge for making a payment after it is due. Late fees are usually a flat fee or 2% of your outstanding balance.

Over-the-Limit Fee – is a charge for making charges above your credit limit

Grace Period - the number of days you have to pay off a new purchase without having to pay a finance charge. The typical grace period is 20-25 days. |

Types and Sources of Credit

There are many different ways to borrow money. Choosing one type of credit over the other depends on your personal situation. It is always wise to borrow as little as possible for the shortest time period possible. The more money you borrow, the more you pay in interest. The longer you take to pay it back, the more you pay in interest.

Single-payment credit – goods and services are paid for in one payment. Usually there is no interest charge. Examples include utilities, doctor bills, and retail stores.

Revolving credit – Credit cards are an example of revolving credit.You are assigned a credit limit - the maximum amount of money you are allowed to spend ($500, $2,000, $10,000, etc.) at an annual percentage rate (APR). Payments are made at regular time intervals for at least the minimum required amount, which is usually $20 or 2% of the balance, whichever is higher. If payment is made for the entire amount, usually there is no interest charge. If payment is made for less than the entire amount, the APR interest is applied to the remaining balance.

Mortgage is a loan for real estate such as a home. A mortgage is taken out for a longer period of time than a typical installment loan, usually 15 to 30 years. The buyers are required to make a down payment or their portion of the total price. The interest rate is lower than for other types of loans, but the length of time yields a great deal of money in the form of interest for the lending institution. |

To learn more about mortgages, open document How Expensive is a Mortgage? and follow directions on the document. The document is an Adobe Acrobat file. Click on the pencil icon to open the document. Save the document to a folder on the computer; then enter answers in the textboxes.

How Expensive is a Mortgage?

How Expensive is a Mortgage?

Check your work by opening document How Expensive is a Mortgage? – Check Sheet.

Types and Sources of Credit

|

Answer Assessment questions 1-11.

Credit – The Good and the Bad

Advantages: Disadvantages:

|

|

Cost of Credit Card Debt

The reason banks and other lending institutions lend money is to make money, so for the most part when you use credit; you are going to pay for it. However, if you pay your bill in full every month, you can usually avoid an interest charge. If you carry a balance, you will end up paying high interest rates. You will never get your credit card debt paid off if you keep charging and make only the minimum monthly payment. Interest will just continue to accumulate.

Cost of Credit on an Unpaid Balance – Example

|

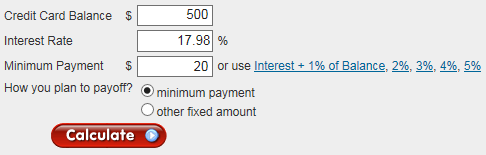

Visit Calculator.net. Use the Credit Card Calculator to determine how long it will take Debbie to pay off her credit card, if she just makes minimum payments each month and how much she will end up paying in interest. Use her original balance of $500 and APR of 17.98%

|

Check your work: If you determined that it would take Debbie 2 years and 8 months to pay off her debt and it cost her $131.16 in interest, you are correct. What could Debbie do with that money if she didn't have to pay it in interest? What would you do with the money?

![]() Interest Rates (03:16)

Interest Rates (03:16)

Let’s Practice Figuring Interest

Open document Interest and follow the directions. The document is an Adobe Acrobat file. Click on the pencil icon to open the document. Save the document to a folder on the computer; then enter answers in the textboxes.

Interest

Interest

Check your work by opening document Interest – Check Sheet.

Control Your Credit. Don’t let Credit Control You.

It is very easy to fall into the credit card trap. According to creditcards.com, the average credit card debt per American household $15,788. The average credit card debt for seniors in college is $4,100. 41% of cardholders age 18 to 29 make only minimum payments on their credit cards. For these people, credit controls them; they don’t control their credit. They end up paying thousands in interest. This is money they could use elsewhere.

Additional Problems Associated With Using Credit

- It is very easy for most people to get a credit card.

- It is tempting to make only the minimum monthly payment.

- It may cause you to ignore your financial goals.

- It may cause you to forget your budget.

- It is easy to overspend trying to keep up with what your friends are buying.

- It makes spending easy and addictive.

True Story

While standing in line at a college book store I overheard the following conversation.

|

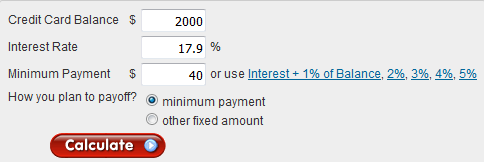

And that is how it happens. It is so tempting to buy what we cannot afford when we have access to credit. Do not fall into that trap because you could end up paying . . . . Well, let’s figure it out. If “Student 1” spends up to his $2000 limit and can only afford to pay minimum payments of $40 every month with an APR of 17.9%, how long will it take him to pay off the credit card and how much will be pay in total interest?

Visit Calculator.net. Use the credit card calculator to find out how long it will take "Student 1" to pay off his credit card and how much he will pay in interest.

|

If you discovered that with the minimum payment every month of $40, it will take him 7 years and 9 months to pay off the credit card, and he will pay $1,700.44 in interest over that time – you are correct.

Tips for Using Credit Cards

|

![]() Pay More Than the Minimum (01:25)

Pay More Than the Minimum (01:25)

How to Get the Advantages of Credit Cards Without the Hassle

Prepaid Reloadable Cards – You purchase a card worth a set amount of money, let’s say $100. You use the card as you would a credit card except when you spent it all, you need to add more money. There is no bill, no interest charge, and no balance to pay off.

Debit cards offer the convenience of credit cards without spending money you don’t have. A debit card looks like a credit card; the difference is it works like a checking account. When you use a debit card, the money for the purchase is deducted electronically from your account. Credit cards require you to pay the bill at the end of the month. Debit cards take the money out of your checking account immediately.

Layaway – Layaway plans existed before credit cards and are coming back into popularity. You make a payment every week on an item that the retail store holds for you. Once you have paid the entire amount, the item is yours. Usually there is no fee, but if there is, it is minimal. |

Payday Lenders

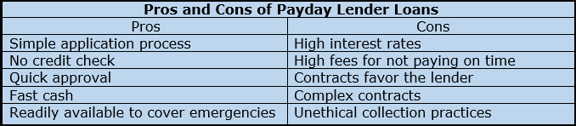

Businesses referred to as Payday Lenders are currently a popular source of short-term credit. Through brick-and-mortar storefronts or online sites, they offer short-term loans and are used to supply quick cash to the unbanked, a term used to refer to adults without bank accounts. Those between the ages of 18 and 24 make up one of the largest groups within this segment of the U.S. population. Payday Lenders advertise heavily and stress the fact that they do not require a credit check. Customers sign contracts for short-term loans and pay them back when they receive their next paycheck. They can be useful to cover an emergency, but the amount of money repaid is much higher than the amount originally borrowed. When considering a loan from a Payday Lender, keep in mind the pros and cons listed in the table below:

|

Answer Assessment questions 12-25.