The True Cost of Car

Ownership

Learning

Objective

The student will be able to calculate their monthly payment based on financing options, estimate vehicle registration costs, title fees, and sales tax, understand the need for and cost of car insurance, accurately determine and budget for common maintenance costs, and estimate monthly fuel consumption and budget.

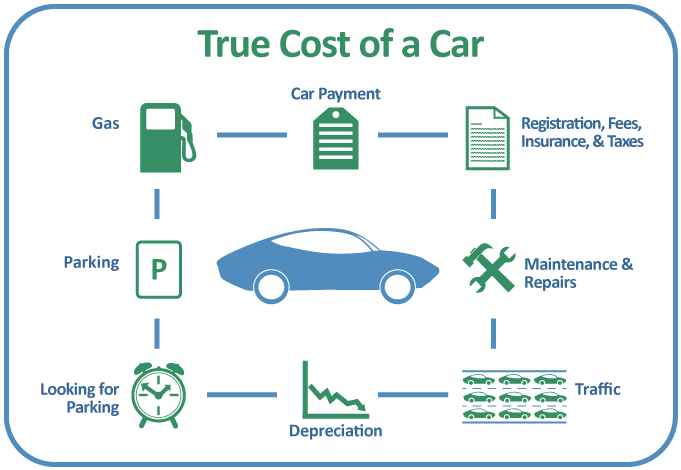

When it comes to owning a car, the sticker

price is just the beginning. This lesson aims to equip students with the

knowledge and tools to understand the true cost of purchasing and maintaining a

car. By focusing on smart budgeting, students will learn to anticipate both

expected and unexpected costs associated with car ownership.

Understanding Car Financing

Car financing is a common method used to purchase a vehicle when you don't have enough cash to pay the full price upfront. This process involves taking a loan, which is then repaid in monthly installments over a set period. Understanding how car financing works is crucial for anyone considering buying a car through a loan.

The Basics of Car Financing

Car financing is

essentially a loan. Like any loan, it has three main components: the principal

amount, the interest rate, and the loan term.

1.

Principal: This is the total amount of money you borrow.

2.

Interest Rate: The lender charges this as a percentage of the principal. It can be

fixed or variable.

3.

Loan Term: This is the duration over which you will repay the loan, typically in

months or years.

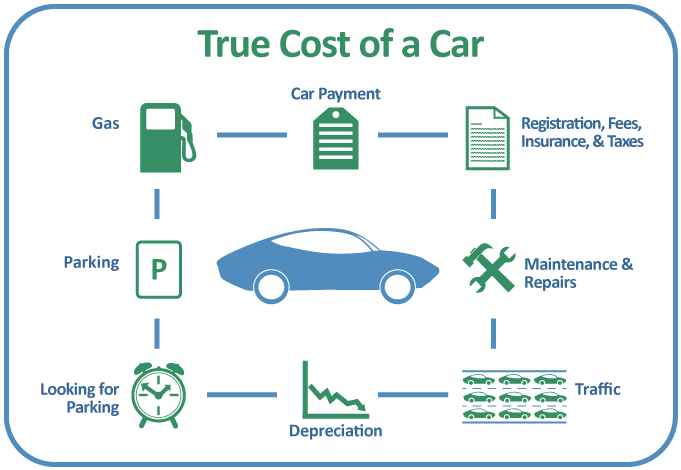

Calculating Monthly Payments

Your monthly car loan

payment depends on the loan amount, the interest rate, and the loan term. The

formula to calculate the monthly payment is:

Where:

·

P is the principal amount (loan amount)

·

r is the monthly interest rate (annual interest rate divided by 12)

·

n is the total number of payments (loan term in months)

Understanding this

calculation is important to determine how much you'll pay each month and

whether it fits into your budget.

Interactivity: Car Loan Calculator

Now let's put this

knowledge into practice with an interactive car loan calculator. You can input

different loan amounts, interest rates, and terms to see how they affect your

monthly payment.

Owning a car involves

various expenses beyond the initial purchase price. Among these are vehicle

registration, title fees, and sales tax. It's important for potential car

owners, especially those budgeting for their first vehicle, to understand and

estimate these costs.

Vehicle Registration

Vehicle registration

is the process of registering your vehicle with the state’s department of motor

vehicles (DMV). This registration proves your legal ownership and allows the

vehicle to be driven on public roads.

Cost Factors:

·

Vehicle Type: Different types of

vehicles may have different registration fees.

·

Vehicle Age: Some states charge

different fees based on the age of the vehicle.

·

Vehicle Weight: Heavier vehicles

may incur higher registration fees.

Title Fees

The title fee is the

cost for the vehicle’s title, a legal document proving ownership.

Typical Costs:

·

The cost for a title varies by state

and sometimes by the value or age of the vehicle.

Sales Tax

Sales tax is a

percentage of the purchase price of the vehicle, charged by most states.

Estimation:

·

Sales tax is calculated as a

percentage of the vehicle’s purchase price.

·

The rate varies by state and sometimes

by locality within the state.

Interactive Estimator: Vehicle Costs Calculator

This calculator will

allow students to input the vehicle's value and select their state to estimate

registration costs, title fees, and sales tax.

The Necessity and Cost of Car Insurance

Car insurance is a

critical component of vehicle ownership. It serves as a financial safeguard

against potential losses due to accidents, theft, or damage. Understanding the

necessity and factors affecting the cost of car insurance is vital for every

driver.

Car insurance

provides financial protection in case you’re involved in an accident. It can

cover repair costs, medical expenses, and legal fees, depending on the

coverage. Most states require drivers to

have at least a minimum level of liability insurance. This insurance pays for

any damage or injuries you may cause to others in an accident.

Factors Affecting Insurance Cost

1.

Driver’s Age: Younger drivers typically face higher premiums due to their

inexperience, while older, more experienced drivers tend to have lower rates.

2.

Driving Record: A history of accidents or traffic violations can increase your

insurance premiums.

3.

Location: Insurance costs can vary depending on where you live due to factors

like accident rates, car thefts, and repair costs in the area.

4.

Type of Vehicle: More expensive vehicles generally cost more to insure. Also, cars with

good safety records may have lower insurance costs.

Interactive Feature: Car Insurance Cost Estimator

This tool allows

students to input different variables and get an estimated insurance cost.

Budgeting for Common Maintenance Costs

Regular maintenance is crucial for keeping a car in good working condition and ensuring safety on the road. Understanding and budgeting for these maintenance costs is an essential part of responsible car ownership.

Typical Maintenance Items

1.

Oil Changes: Necessary for lubricating engine parts and keeping the engine running

smoothly. Typically required every 3,000 to 5,000 miles.

2.

Tire Rotations: Helps in even tire wear, extending the life of the tires. Recommended

every 6,000 to 8,000 miles.

3.

Brake Pad Replacements: Essential for safe driving. Brake pads need replacement every 20,000 to

25,000 miles, depending on driving habits.

4.

Unexpected Repairs: These can include issues with the engine, transmission, or other parts

of the car and can vary widely in cost.

Budgeting Strategy

To budget for

maintenance costs:

·

Research Average Costs: Look up the average

costs for these services for your specific car model.

·

Set Aside Monthly Amounts: Divide the total

estimated annual maintenance cost by 12 to determine how much to save each

month.

·

Emergency Fund: It's also a good idea to have an

emergency fund for unexpected repairs.

Interactive Feature: Maintenance Cost Calculator

This calculator allows users to input their car model and mileage to get an estimated maintenance budget.

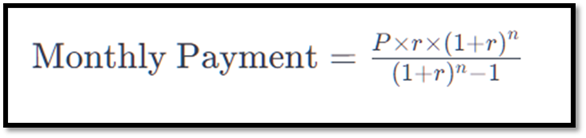

Fuel costs are a

significant part of the monthly expenses for car owners. Estimating and

budgeting for fuel consumption is essential for effective financial planning.

Understanding your car's fuel efficiency and your driving habits can help you

accurately estimate these costs.

Miles Per Gallon (MPG):

This rating indicates

how many miles a car can travel on one gallon of fuel. Higher MPG means better

fuel efficiency. You can typically find this information in your car's manual

or online.

Fuel Cost Calculation

To estimate your

monthly fuel cost:

1.

Estimate Monthly Driving Distance: Calculate or estimate the total number of miles you drive in a month.

2.

Divide by MPG: Divide this number by your car's MPG rating to find out how many

gallons of fuel you'll need for the month.

3.

Multiply by Fuel Price: Multiply the number of gallons by the current price per gallon to

estimate your monthly fuel cost.

Interactive Feature: Fuel Cost Calculator

This tool allows users

to input their car's MPG, their estimated monthly mileage, and the current fuel

price to get an estimated monthly fuel cost.

<

Activity: The True Cost of Car Ownership

Students will use

interactive tools to calculate and understand the various costs associated with

owning and maintaining a car based on a given scenario.

Scenario

You have just

graduated and landed your first job. You're planning to buy a car to commute to

work and for personal use. The car you're interested in has a sticker price of

$25,000. You live in a state with a 6% sales tax rate, and the average vehicle

registration and title fees in your area are $200 and $50, respectively. Your

annual mileage estimate is 15,000 miles. Assume you've found a car loan with a

5% interest rate for a 5-year term.

Instructions

1.

Car Loan Calculator

·

Use the Car Loan Calculator to determine

your monthly car payment.

·

Enter the following details:

o

Loan Amount: $25,000

o

Annual Interest Rate: 5%

o

Loan Term: 5 years

2.

Vehicle Costs Estimator

·

Calculate the initial costs including

sales tax, registration, and title fees.

·

Enter the following details:

o

Vehicle Value: $25,000

o

Sales Tax Rate: 6%

o

Estimated Registration Fee: $200

o

Estimated Title Fee: $50

3.

Car Insurance Cost

Estimator

·

Estimate the annual cost of car

insurance. Assume you are a 23-year-old living in an urban area with a clean

driving record and the car is a standard model.

·

Use the Car Insurance Cost Estimator

with appropriate values.

4.

Maintenance Cost

Calculator

·

Calculate the estimated annual and

monthly maintenance costs based on your annual mileage.

·

Enter an Annual Mileage of 15,000

miles in the Maintenance Cost Calculator.

5.

Fuel Cost Calculator

·

Estimate your monthly fuel costs.

Assume the car's MPG is 25 and the current fuel price is $3 per gallon.

·

Enter the details in the Fuel Cost

Calculator.

Task Completion

Use the following

document to complete this task.

True

Cost of Car Ownership Activity

·

After using each tool, record the

calculated amounts in a table.

·

Sum up the monthly costs (loan

payment, insurance, maintenance, fuel) to find the total monthly cost of owning

the car.

·

Reflect on the costs: Were they higher

or lower than expected? How could these costs impact your monthly budget?

Reflection

Write a short

reflection on your findings. Consider the following questions:

·

How does understanding these costs

influence your decision about buying a car?

·

What factors would you consider most

important in the future when purchasing a vehicle?

Submission

Submit the completed

calculations and your reflection essay.