Taxes

The federal government collects taxes. In this

section, you will learn about the different kinds of taxes.

Key Terms

ü deductions: things that can be subtracted from taxable

income

ü Internal Revenue Service (IRS): the government agency

that is in charge of collecting taxes

ü tax return: a person's annual report to the IRS that

summarizes total income, taxes already taken out by the employer, and

deductions

Let’s Practice!

The government is involved in the U.S. economy.

For example, it makes laws that businesses must follow and laws that protect

consumers and workers. In addition to making laws, the government also provides

important public goods and services. To provide these goods and services, the

government needs money. The government gets money through taxes like individual

income taxes, corporate income taxes, and FICA taxes.

Individual

and Corporate Income Taxes

About half of the money the federal government

takes in comes from individual income taxes. Part of the money that people earn

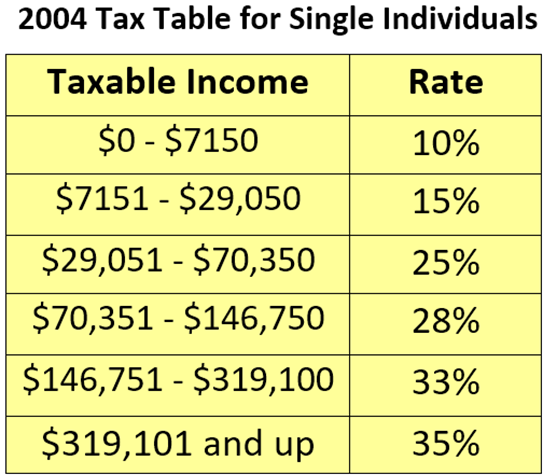

is collected by the government. The percentage each person pays depends on the

amount of money he or she makes. The government takes a percentage of each

person's annual earnings. For example, if a person makes $25,000 per year in

taxable income, he or she is taxed at 15 percent. This means that the person

pays $3,750 per year in income taxes to the federal government.

Most individual income tax is paid through a

payroll withholding system. This means an employer automatically subtracts

income taxes from a person's paycheck and sends it straight to the Internal Revenue Service (IRS). The IRS

is the government agency that is in charge of collecting taxes.

Each year, every employee must fill out a tax return and send it to the IRS. A

tax return is a person's annual report to the IRS. It summarizes total income,

taxes already taken out by the employer, and deductions. Deductions are things that can be subtracted from your

taxable income, like donations to charity, some medical expenses, and state and

local tax payments. Sometimes, the amount of income tax that a person owes is

different from the amount already paid. If you paid more than you were supposed

to, you will get money back. If you did not pay enough, you must send the rest

of the money owed to the IRS.

The chart below shows the different tax

brackets for individuals. Like individuals, corporations must pay income taxes.

Corporations have tax rates that vary just like the rates for individuals. The

more money a corporation makes, the higher its tax rate will be.

|

FICA

Taxes

Employers take money out of each employee's

paycheck for another type of tax besides individual income tax. These taxes are

authorized by the Federal Insurance Contributions Act, or FICA. FICA taxes

provide money for two government programs: Social Security and Medicare.

Social Security is a program that was started

to help people survive the Great Depression. It started as a fund to provide

people with money to live on after they retired. Today, it also gives benefits

to the surviving family members of wage earners who have died and to people who

cannot work because of disabilities.

Medicare is a national health insurance

program. It helps pay for health care for people 65 and older and people with

certain disabilities.

There are many other taxes taken by the

government. They include excise taxes, estate taxes, gift taxes, and import

taxes. However, income taxes and FICA taxes are the two main taxes taken by the

federal government.

Let’s Practice!