The Federal Reserve

Unit Overview

In this

unit, students will explain how the Federal Reserve System uses monetary tools

to regulate the nation's money supply. (CS #21)

Section A: Content Statement 21

The Federal Reserve System uses monetary

tools to regulate the nation's money supply and moderate the effects of

expansion and contraction in the economy.

Content

Elaboration

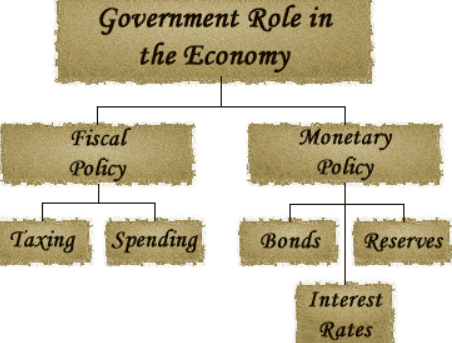

Monetary policy involves the Federal Reserve

System making decisions about the nation's money supply.

To encourage economic growth, the Federal Reserve System can:

• reduce the amount of money that banks must have on reserve

and not use to make loans;

• buy bonds; and

• take action that results in lower interest rates.

To slow economic growth, the Federal Reserve System can:

• increase the amount of money that banks must have on reserve

and not use to make loans;

• sell bonds; and

• take action that results in higher interest rates.

Let's Practice: Content

Statement 21

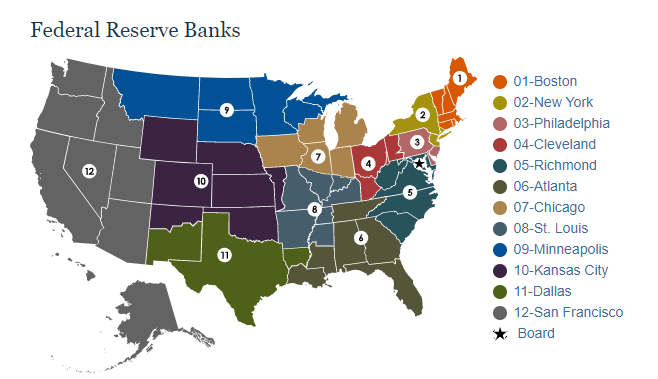

In 1913,

Congress

approved the Federal Reserve Act. This established 12 regional banks. Its purpose was to regulate money supply in

circulation by controlling the amount of money that banks could lend and stabilize

the nation's banking system. The Federal

Reserve is the central bank of the United

States. A Board of Governors oversees

these banks, and their goal is to curb recessions in our nation. The Federal Reserve supervises the banking

industry and makes rules that banks must follow. The Federal Reserve oversees electronic

payment systems and processes the checks people write. When banks need money, they order the

currency from the Federal Reserve. The

main job of the Federal Reserve System is to help keep the United States' economy

healthy.

The Federal

Reserve works toward three goals for a healthy economy:

1. Making sure the highest possible number of citizens have jobs

2. Keeping the price of goods and services stable

3. Making sure the cost of a loan is not too high or too low

Monetary

policy relies on the government's ability to

control the nation's money supply to promote economic growth and

stability. The money supply affects the

overall level of business activity.

In an Economic

Downturn

Action: The Federal Reserve put more money into

circulation

Result: Interest rates go down; businesses borrow more

money; consumers borrow more to spend on homes, cars, etc.

In an Economic

Upturn

Action: Federal Reserve reduces the money supply

Result: Interest rates rise; businesses borrow less;

economic growth is slowed to avoid inflation

Let's Practice: Discount Rate