Managing Debt

Sponsored by

Discover and Discovery Education

Unit

Overview

Managing

Debt: You will learn about

credit reports and the information they include. Then you will learn about

credit scores, including what they are based on and how they are used. The unit

concludes with an exploration of various options for paying off debt and

avoiding debt-related scams.

Section A – Checking Your Credit Report

What is a credit report, and how do you know what is in yours?

|

The Credit Process |

||

|

Credit: goods, services, and/or money received in

exchange for a promise to pay back a definite sum of money at a future date |

||

|

Borrower |

Someone who receives something with the promise to return it

or to repay what is borrowed |

|

|

Lender |

Person or organization who makes funds available for others to

borrow |

|

|

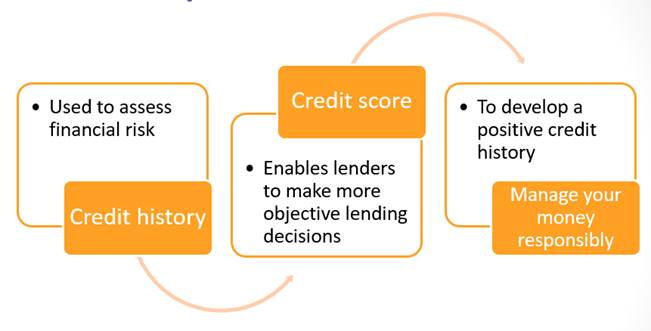

Credit History |

Record of the borrower’s past loan and credit-related

transactions |

|

|

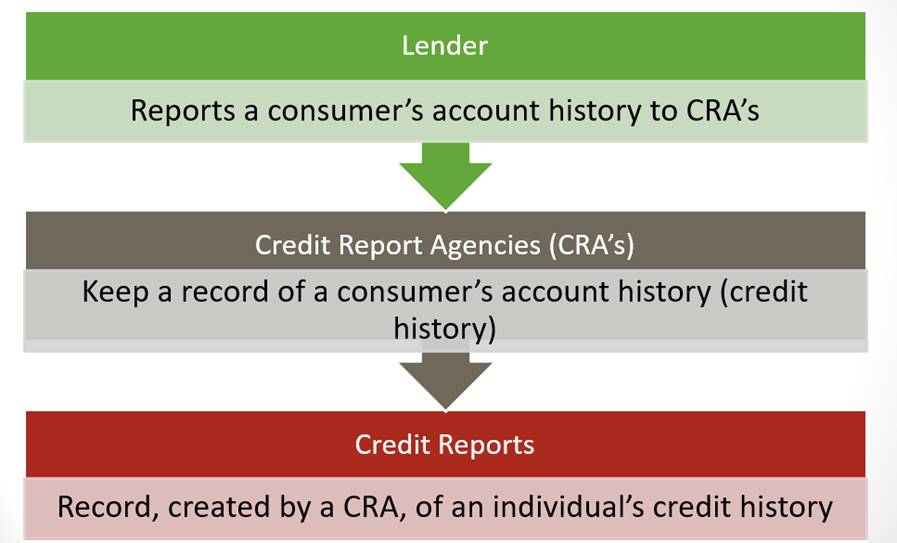

How Credit Reports are Created |

|

|

|

Summary |

|

|

Section B – Improving

Your Credit Score

In this

module, you will explore how lenders judge whether someone will be a good

borrower, the components of a credit score, and how they can improve their

credit score to get favorable loans on houses and cars in the future.

Click below

to begin the module.

Section C – Managing

Debt

In this

module, you will explore various strategies for paying off debt (lowest balance

first vs. highest interest rate first, debt transfer, and consolidation), how

to avoid scams and the consequences of poor debt management.

Click below

to begin the module.