Finding Money to

Save

Sponsored by

Discover and Discovery Education

Unit Overview

In this

unit, Finding Money to Save provides you with the tools and best

practices to save money, set savings goals, and grow their savings through

interest. The unit begins with an exploration of why people save money in which

you are encouraged to reframe the way you think about savingurging you to consider

it as spending in the future. You then will

learn how setting savings goals can help encourage you to save. Next, you will

learn about strategies to save more money and compare technology-enabled

services that encourage people to save.

Section A Deciding to Save Money

Why do people choose to

save money?

In this section, you will create a timeline that represents your

future and consider how you will earn and spend money 5, 25, and 50 years from

now.

People usually save for one of three reasons:

Ψ to reach a savings goal,

Ψ to be prepared for emergencies, or

Ψ for financial security in retirement.

Examples of savings goals that people might have:

Ψ Travel,

Ψ higher education,

Ψ vehicles,

Ψ homes, and

Ψ other large purchases

Young people might set money aside for unexpected car repairs,

or to repair or replace electronic devices. Saving early and often allows

students to take advantage of the power of compound interest. Compounding is

when the interest you earn from your savings and investments is

reinvestedproviding an opportunity to earn even more.

Lets

Practice

Click here to complete an activity on Future Spending.

Section B Choose

to Save

In this

section, you will focus on the reasons people decide to save money and

encourages you to develop a savings plan.

By saving money today, you can have financial security in the future.

What is

Saving?

Ψ accumulation of excess funds by intentionally spending less than

you earn

What is

Savings?

Ψ a portion of income not spent on consumption (purchase of goods and services)

Why save?

Ψ Emergency savings ΰCash set aside to cover the

cost of unexpected events

Ψ Short-term goals & expenses ΰ Pay for items that arent

part of a typical spending plan

Ψ Financial security ΰ Lower stress

How Much

Money Should Be Saved?

Ψ At least six months worth of expenses in emergency savings

Ψ Example: $2,000 monthly

expenses x 6 months = $12,000

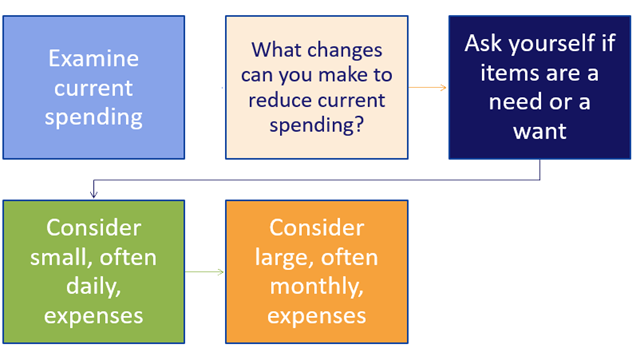

Identifying

Money to Save

Ψ Increase income

Ψ Decrease spending

Lets Practice

Click here to complete an activity on Choose to Save.

Section C Finding

Money to Save

In this

section, you will complete a module on the principles and purpose of saving

money and provide you strategies for saving money.

Click

below to begin the module.