CHECKING &

SAVINGS ACCOUNTS

Unit

Overview

In this unit you will learn how to write checks, record your checkbook progress, reconcile your checking account, and compare different types of savings accounts.

Checking

Accounts

A checking account will allow you to pay bills or expenses without carrying or mailing large amounts of cash. When you open a checking account at a bank or credit union, you receive a checkbook with a supply of checks and a check register in which you keep a record of your account. Each check will be printed with your name and address, the number of the check, the name of the bank where you have the account, and your account number. You will also receive deposit slips that are used when you put money in your account. When you make a deposit, or put money into your account, the value of the cash is added to your balance. When you write a check, the amount indicated on the check is subtracted from the balance in the account.

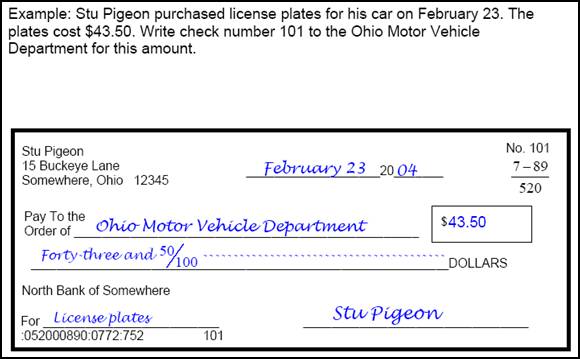

In order to keep anyone from changing a check, you should:

v Write the numbers as close to the dollar sign as possible.

v Draw a line from the amount written as words to the word dollars.

Keeping

a Record

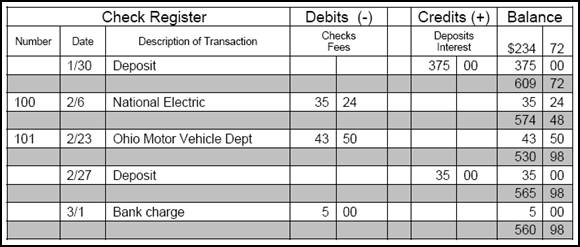

You should keep a record of every check you write so that you know how much money is left in your account. This record is called a check register and keeps such information as the date, the check number, to whom the check was written, the amount of the check, and your new balance. The figure below illustrates how checkbook records are kept.

Balancing

Your Checking Account

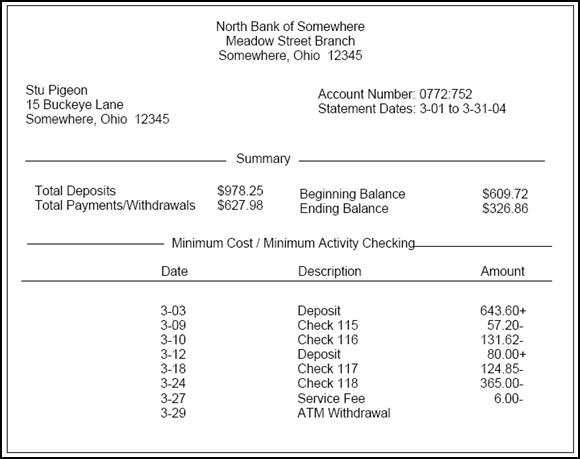

Once a month, the bank will send you a statement of your checking account. This statement will show you the amount of each deposit and the amount paid out of your account for each check. It will also show other charges that the bank imposes on you such as service charges and charges per check written. It is necessary to reconcile your account each month. This means you must account for any differences between the balance on the bank statement and the balance in your check register. An example of a bank statement for Stu Pigeon is shown below.

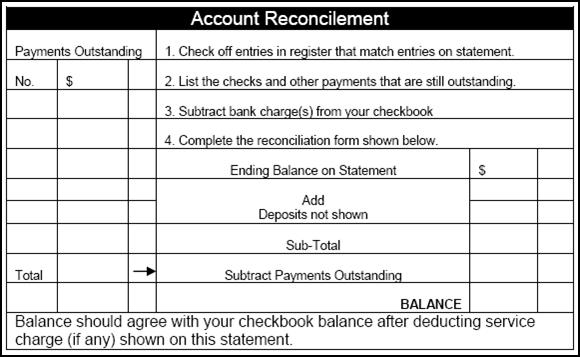

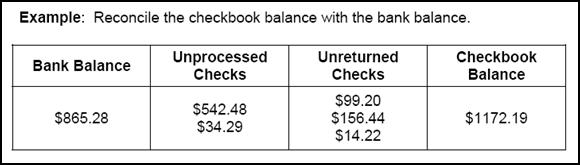

Along with your statement you will receive a worksheet that guides you through the reconciliation of you checkbook. A typical worksheet would look like the one below.

Step 1:

Start with the Bank Balance, and add on any “Unprocessed Checks”.

$865.28

+(542.48 + 34.29) = $1442.05

An unprocessed check is a check that you receive as income, deposit into your account, and add the amount to your checkbook balance. However, the bank statement may have been sent out before the deposit was credited to your account; thus, is not included in the bank statement and balance. In the sample “Account Reconcilement” statement above, the “deposits not shown” are unprocessed checks.

Step 2:

Next, subtract any “Unreturned Checks”.

$1442.05

– (99.20 + 156.44 + 14.22) = $1172.19

An unreturned check is a check that you write and then subtract its amount from your checkbook balance. However, the bank statement does not show that the check has been processed at the time the statement was issued. There may be many reasons for this occurrence. One such reason is that a recipient of the check may not have cashed the check by the time the bank statement was sent out. In the sample “Account Reconcilement” statement above, the “outstanding checks and payments” are unreturned checks. The bank statement and the checkbook register have been reconciled and the balance of the checking account is $1172.19.

To learn more about balancing your checkbook, watch the video below.

Savings

Accounts

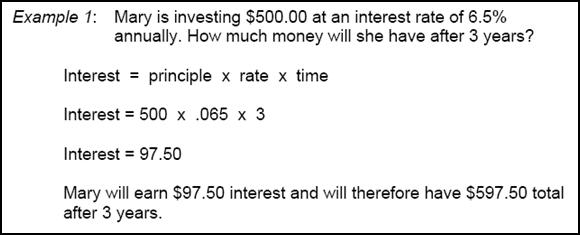

Saving is the act of putting aside some of today’s income for tomorrow’s needs and goals: for example, the down payment on an awesome stereo system. People save money for different reasons; they save for emergencies, for irregular or seasonal expenses, and for their goals, including a financially secure future. The best reason for opening a savings account is that the bank pays you interest to keep your money on deposit. A bank or credit union has a not-for-profit status, but you must understand that it is still a business. Therefore, the reason they pay you to have your money in their bank is because they lend your money out to borrowers for a higher amount of interest. The amount of interest that you are paid is figured in different ways. One way is to multiply the amount of money you have in your account by the interest rate (a percentage established by the bank). The result is the amount of interest you receive in a year. If your money is in a savings account for longer than a year, you would multiply the amount by the interest rate and then by the number of years. If months are used, you must rewrite the months as fractional parts of the year.

|

Interest = |

principal |

x rate |

x time |

|

|

$ |

% |

years |

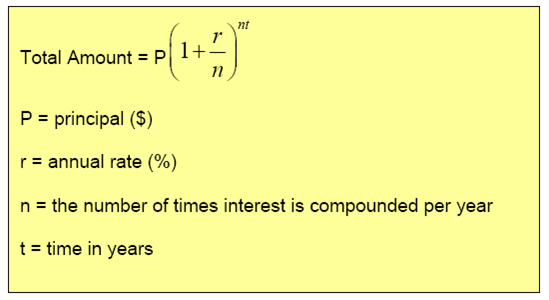

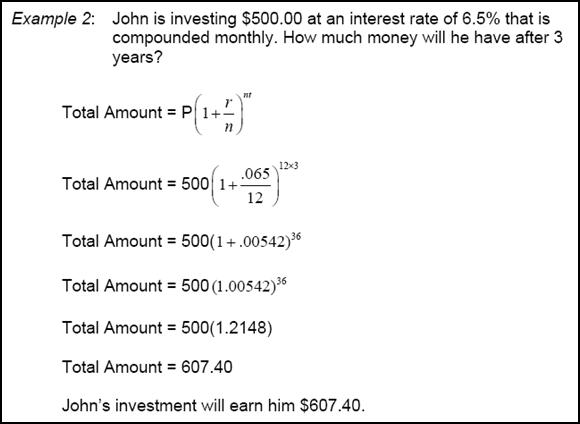

Another type of interest is called compound interest; the interest you earn also earns interest. This type of interest makes your savings grow much faster. Compounding can take place at different periods: once a day (daily, 365 times), once a month (monthly, 12 times), once a quarter, (quarterly, 4 times), and once a year (yearly, 1 time).

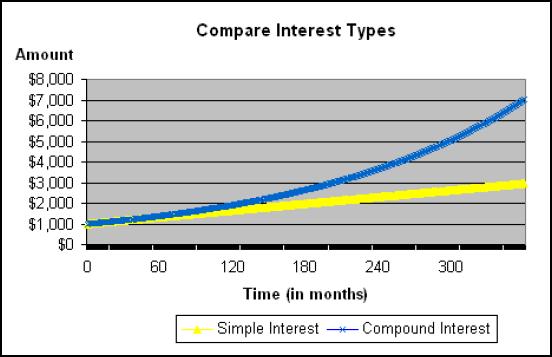

Let’s compare simple interest with compound interest. The graph below represents simple interest and interest compounded monthly, for $1000.00 at a 6.5% interest rate for 30 years.

What is the difference in value of $1000 saved at 6.5% for 30 years with simple interest as compared to compound interest?

The value of $1000 saved with simple interest for 30 years is about $3000; whereas the value for the same amount of money saved with compound interest is about $7000, a $4000 difference!!!

Let’s try an example of computing simple interest and compound interest.

To learn more about different types of savings accounts, watch the video below.

|

| Unit 5 Keeping a Running Balance Worksheet |

| Unit 5 Keeping a Running Balance Answer Key |

| Unit 5 Reading a Bank Statement Worksheet |

| Unit 5 Reading a Bank Statement Answer Key |