FINANCING A HOME

Unit Overview

In this unit we will investigate the costs of owning a home. First, we will take a look at how to finance a home. You will learn how to compute the down payment and then determine the amount of a monthly house payment. We will determine the cost of property taxes and homeowners insurance. We will conclude the unit by learning about home maintenance and improvements.

Making a Down Payment

The cost of a house depends on many factors. The size and location of the lot, the type of materials used to build the house, the size of the house, and special features on the house are a few of these factors. When you buy a house, you may need to borrow money from a bank or mortgage company. Most lenders require a down payment that is a percentage of the price of the house.

One common rule for deciding how much you can afford to pay for a house is to multiply your annual income by 2˝. If a house costs more than 2˝ times your annual income, it may represent too much of a debt for you.

Mortgage Payments

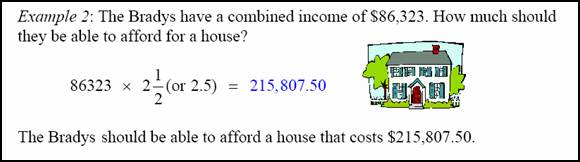

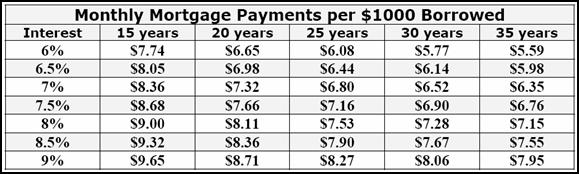

Once you have decided to buy a house, you will have to arrange a way to finance it, or pay for it. Most people mortgage their homes through banks or mortgage companies. There are several kinds of mortgages available, and you can save a lot of money on the interest by paying back your mortgage over a shorter period of time.

When you pay back a mortgage, part of each payment goes toward the principal of the loan and the interest is calculated on the new balance. The table below gives an example of the monthly payments for borrowing $1000 at different rates of interest. To find your mortgage payment, multiply the payment from the chart by the number of 1000’s you are borrowing.

Property Taxes

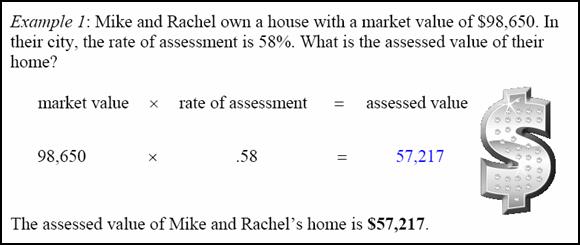

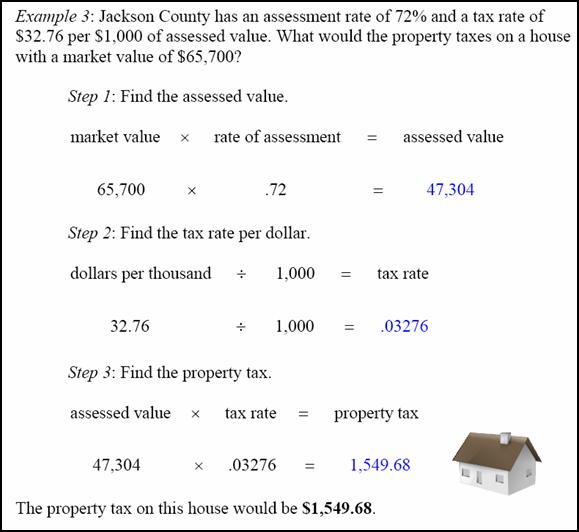

After buying a home, you are responsible for paying property taxes. The major source of revenue for a city is a tax that is levied on all property within the city. This property tax is also known as real estate tax. This tax is based on a percentage of the actual value (market value) of your property. This value is called the assessed value and the percentage used, called the rate of assessment, is determined by individual cities. Follow the example below to determine the assessed value of the home.

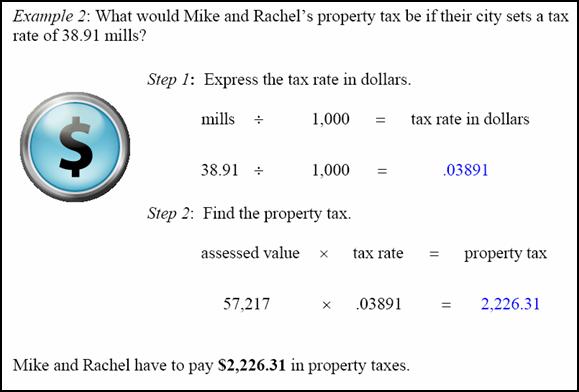

Tax rates are also set by the city based upon the amount of money that it needs to operate and the total assessed value of the property within its boundary. This tax rate is expressed in mills, or tenths of a cent, per dollar of assessed value. One mill is equal to $.001. To express the tax rate in dollars, divide the number of mills by 1,000.

Let’s take a look at another example.

Homeowner’s Insurance

When you buy a home, you will be required by the bank or mortgage company to insure your home against such things as fire, storms, theft, and vandalism with homeowner’s insurance. Most insurance companies require that you insure your house for at least 80% of its replacement value. The replacement value is the cost of replacing your home at the current costs of materials and labor if it is destroyed.

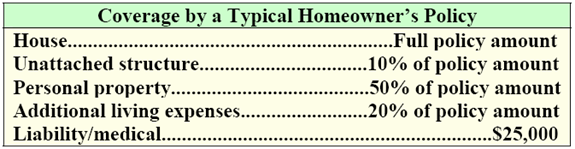

Homeowner’s insurance doesn’t just cover the home itself. It can also cover unattached structures, (garages, sheds), personal property (clothes, furniture), damage to the property of others, liability and medical expenses for someone injured on the property, and additional living expenses if the people in the house must live somewhere else. The following table shows the typical coverage offered by a homeowner’s policy.

Let’s take a look at an example of how much a couple could recover if something happed to their home. We will use the table above as a reference.

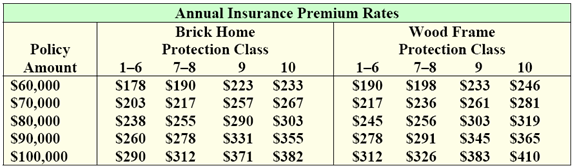

The cost of an insurance policy, or the rate, is based not only on the policy amount but also on the building materials used for the house, how close you live to a fire station, the presence of smoke detectors, how close you live to flood zones, and other factors. An example of a rate schedule is given below in the table. Notice that there are different protection classes. Your protection class is based on the factors that were listed above.

Home Maintenance and

Improvements

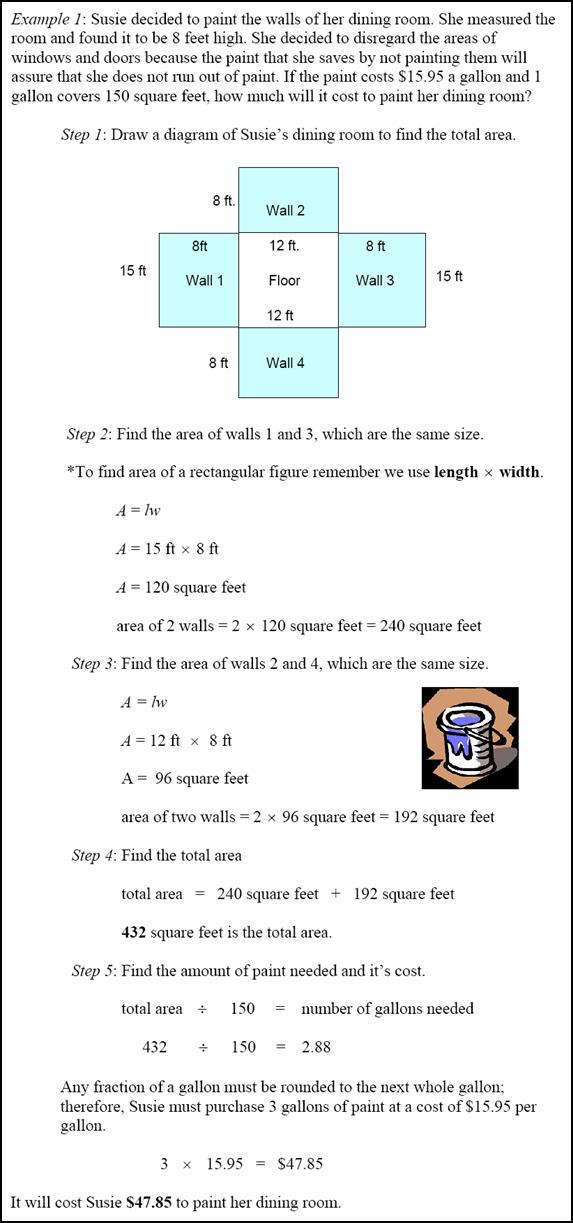

A home is an investment that will grow in value. One way to make sure that this happens is to keep current on repairs and improvements. Home maintenance such as painting and replacing damaged materials will help maintain the value of a home. Home improvements (remodeling) will actually increase the value of a home.

Let’s take a look at some examples of how a person may maintain or improve a home.

|

| Unit 15 Buy It or Pass? Worksheet |

| Unit 15 Home Sweet Mortgage Worksheet |

| Unit 15 Loans, Loans, Loans Worksheet |

| Unit 15 Home Sweet Home: Purchasing a Place Worksheet |