COMPUTING NET PAY

Unit Overview

In this unit you will learn about an earnings statement. You will also learn about the deductions that are made on your paycheck for federal, state, local, and Social Security taxes.

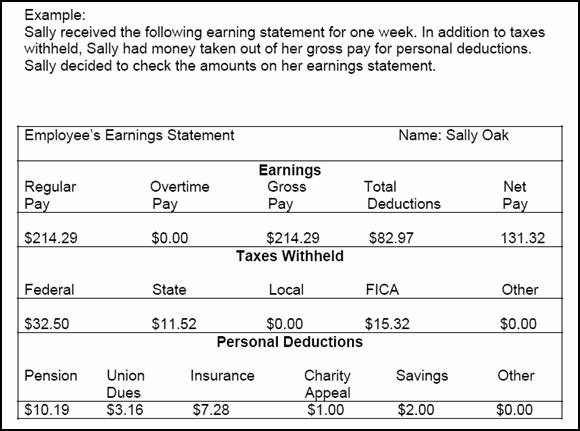

Earnings Statement

When you receive a paycheck from an employer, you will receive an earnings statement, the record of earning and deductions. This statement will show gross pay, or total pay. It will also show the net pay, or take home pay, and the amounts which have been withheld for taxes and personal deductions.

It is a good idea to check the amounts on your statement to be sure they are correct. By checking your earnings statement you will have a better idea of how much is being withheld for taxes and other deductions, or amounts withheld on a paycheck.

We will discuss each of the tax withholding categories throughout this unit.

1) Find the total amount withheld for taxes. Find the sum of these amounts in the row labeled “Taxes Withheld”.

$32.50 + $11.52 + $15. 32 = $59.34

Total taxes withheld: $59.34

2) Find the total amount of personal deductions. Find the sum of the amounts in the row labeled “Personal Deductions”.

$10.19 + $3.16 + $7.28 + $1.00 + $2.00 = $23.63

Total personal deductions: $23.63

3) Verify that the amount under Total deductions is correct. Find the sum of the total taxes and total personal deductions.

$59.34 + $23.63 = $82. 97

The amount under Total Deductions is correct.

4) Verify that gross pay minus net pay equals total deductions. Find the difference between gross pay and net pay.

|

$214.29 |

gross pay |

|

- $131.32 |

net pay |

|

$82.97 |

total deductions |

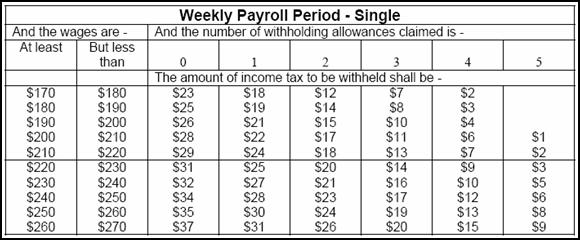

Federal Income Tax

Employers are required by law to hold back a portion of each employee’s salary from every paycheck. This amount is applied toward the federal income tax. In order to determine how much to withhold, employers use tax tables like those below.

There are a couple of factors used to determine the amount withheld from a paycheck. Such factors are whether the worker is married or not, how much the worker earns per pay period, and the number of exemptions, or amounts that can be deducted for dependents. An employee may claim exemptions for himself or herself, for his or her spouse, and for any children whom the employee supports.

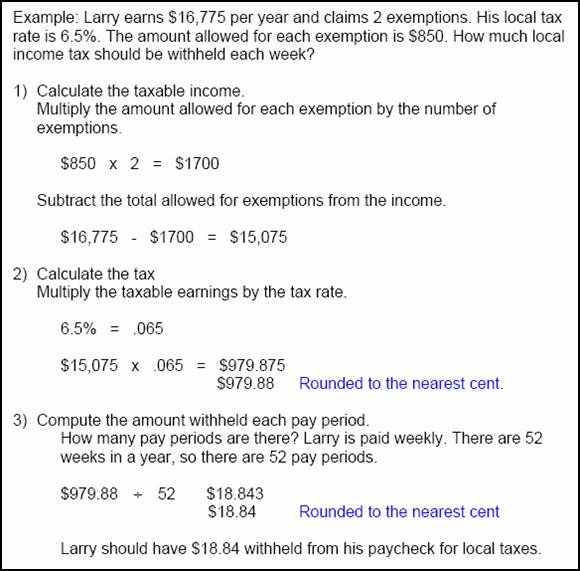

State and Local

Income

Along with federal taxes, employers are often required to withhold state and local income taxes. The amount withheld is usually figured as a percentage of the worker’s taxable earnings. Taxable earnings depend on the number of exemptions claimed by the employee. To determine the taxable earnings, multiply the number of exemptions by the amount allowed for each exemption. Then subtract this amount from the annual earnings.

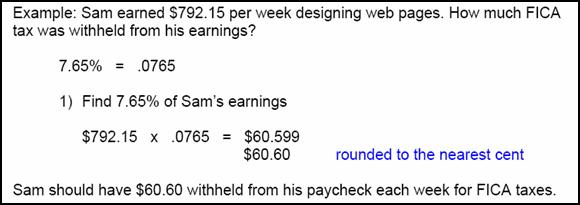

Social Security

(FICA) Tax

The original Social Security Act, also known as the Federal Insurance Contributions Act, or FICA, was passed in 1935. Your social security contribution gives four kinds of protection: retirement benefits, survivors’ benefits, disability benefits, and Medicare benefits. Unless you pay into your own retirement system, your employer will withhold a percentage of your pay for Social Security taxes. The amount withheld is determined by taking a percentage of your pay. For our purposes, we will say that the percent is 7.65% of your earnings.

|

| Unit 4 Earning Power Worksheet |

| Unit 4 Earning Power Answer Key |

| Unit 4 Read and Interpret Pay Stubs Worksheet |

| Unit 4 Read and Interpret Pay Stubs Answer Key |