FREE TRADE VERSUS PROTECTIONISM

President Trump

Speaking in Ypsilanti, Michigan: March,

2017

Unit

Overview

In

the previous unit, you looked at some simple examples of the economic

principles underlying the international exchange of goods and services. Trade, however, does not occur in a vacuum,

and a number of factors impact how it is conducted. One of the most significant

is government regulation. Many Americans

argue that quotas, tariffs and subsidies are necessary to save jobs and to

protect growing industries. Others

insist that these actions only harm consumers and put off inevitable changes in

employment patterns. Should producers

benefit at the expense of consumers? Do

we need more or fewer laws governing trade?

Is free trade the most beneficial course of action? Let's

see how it all works.

Free

Trade and Protectionism

Free trade is a system that

permits nations to exchange goods and services without government

interference. This eliminates

regulations, taxes and licenses. Since

each country has a comparative advantage when it produces certain items, free

trade, at least in theory, is the most efficient way to use scarce

resources. For this reason, it wins the

approval of most economists. For

consumers, it offers more choices, better quality and lower prices. Jobs and incomes naturally increase in export

industries, and the overall standard of living rises. Free trade also inspires countries to work

together and encourages foreign investment.

So what's not to love about free trade?

It

is often assumed that free trade benefits everyone, but this is not true. Although its overall impact is often

positive, not all regions within a country profit equally. Therefore, for some people, there is plenty

not to love about free trade. These

individuals propose that the government establish trade barriers, such as tariffs, quotas and subsidies, to give the

home country an advantage over foreign imports.

This policy is called protectionism. Since some trading partners ignore human

rights, pay very low wages and have weak environmental standards,

protectionists advocate trade barriers to keep domestic industries

competitive. This is sometimes referred

to as leveling the playing field. Protectionists

contend that it helps to keep jobs and incomes in local communities. In addition, critics of free trade warn that

it is dangerous to become too dependent on imported goods. Because some products may be essential to

national defense, governments may choose to impose trade barriers. By taking this action, they ensure that

certain industries continue to operate.

Protectionism also shelters new,

or infant, industries as they

grow and strengthen. At the same time, proponents

insist that protectionist policies conserve energy and decrease environmental

damage. Goods produced and sold within

national borders result in less packaging and lower fuel consumption. Because both sides continue to present valid

arguments, it appears that the controversy surrounding free trade will not be

resolved anytime soon.

![]() Go to Questions 1

through 7.

Go to Questions 1

through 7.

Trade

Barriers

Today,

most nations have some barriers that limit free trade. A trade barrier is defined as any restriction

that prevents foreign goods and services from freely crossing a country's

borders. Common trade barriers include

quotas, voluntary export restraints (VERs), tariffs and subsidies. As with all choices, these options come with

opportunity costs.

Ø Quotas: A

quota is a law that sets a specific limit on the amount of a good that can be

imported. It reduces the total supply of

a particular product and keeps prices high for domestic producers. For example, the United States restricts the

amount of sugar than can legally enter the country by setting a quota of 5.8

billion pounds per year. Once shipments

from foreign countries reach this total, the importation of sugar ceases. As a result, the price of a pound of sugar

within the U.S. averages $.43, but the average price per pound on the world

market is $.27. American producers

benefit at the expense of consumers, who pay higher prices. On the other hand, if sugar imports remain

unlimited, most U.S. producers would be out of business, and an estimated 3,000

jobs would be lost.

Sugarcane

Fields in Brazil, the World's Largest Sugar Producer: Image Courtesy of Mario Roberto Duran Ortiz

Ø Voluntary export restraints: Unlike a quota, a voluntary export restraint

(VER), is not a law. It is a

self-imposed limit on the number of products that one nation can ship to

another. In 1981, lower-priced Japanese

vehicles competed intensely for American customers. This threatened the stability of the U.S.

auto industry. The Reagan administration

asked Japan to lower the amount of its auto exports to the United States

voluntarily. The Japanese government

agreed because U.S. negotiators threatened to set up harsher trade barriers if

Japan refused. Although this deal

benefitted American manufacturers, it came with trade-offs. This voluntary export restraint reduced the

choices available to consumers and increased the prices of all vehicles sold in

the United States.

Ø Tariffs: Before

the collection of personal income tax, taxes on imported goods, or tariffs,

were the American government's primary source of revenue. Today, most tariffs are levied to protect

U.S. farmers and manufacturers from foreign competition. Here is an example of how it works. Let's say that it costs $1 to produce a

stress ball in the United States.

However, an American retailer can import the same stress ball for

$.35. By placing a tariff of $.95 on

this item, the cost of the foreign stress ball increases to $1.30. The American-made stress ball is now cheaper

than the foreign import. While this

protects those who produce stress balls in the United States, it forces

consumers to pay more for the same item.

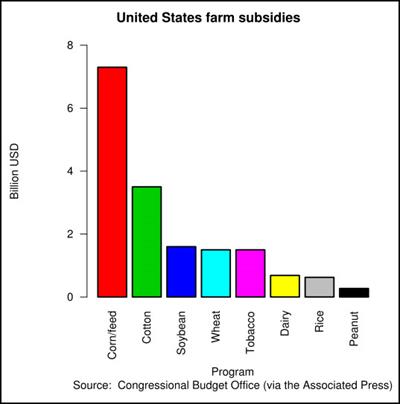

Ø Subsidies:

National leaders recognize that certain businesses are necessary for the

well-being of their citizens and for economic stability. When these industries struggle to survive due

to competition from foreign imports, governments sometimes provide cash

payments or tax reductions to help.

These supports are called subsidies.

The U.S. government provides this assistance to a variety of businesses,

groups and individuals, including American farmers. When used for this purpose,

economists consider subsidies barriers to trade because they permit farmers to

sell at low, competitive prices while maintaining their income. Proponents of this policy argue that it keeps

family farms in business and decreases dependency on overseas markets for

food. However, all income earners pay

for these subsidies in the form of higher taxes.

U.S. Farm Subsidies: Graph Courtesy of Arichnad

Ø Other barriers:

Safety regulations, health standards and licenses sometimes represent

less formal barriers to trade. If a

business must obtain a license to sell goods in a certain country, high fees

and slow processing can delay and eventually prohibit sales. Countries may also apply health and safety

regulations that are very demanding and, in turn, discourage imports. By establishing rules that are too difficult

for most sellers to follow, a nation can sharply reduce and even eliminate

competition within its borders.

![]() Go to Questions 8

through 14.

Go to Questions 8

through 14.

Trade

Wars

Although

trade barriers can benefit the country that initiates them, they can cause

long-term, negative outcomes. When one

country limits imports, its trading partners may respond by setting their own

restrictions. This creates an escalating

cycle of trade barriers, known as a trade

war, and it can have serious economic consequences for all the nations

involved. Just as increased trade

benefits all trading partners, a decrease in trade harms all trading partners.

The

United States learned just how devastating a trade war can be in 1930. To combat the effects of the Great

Depression, Congress passed the Smoot-Hawley

Tariff. This act raised the tariff

on all imports to 50%. Congress reasoned

that this law would protect American workers from foreign competition and would

provide income to buy American products priced lower than their foreign

counterparts. Other countries, however,

quickly responded and raised tariffs on American-manufactured goods. This resulted in a trade war that closed

foreign markets to U.S. products and reduced the demand for goods

worldwide. International trade declined

dramatically, and economic conditions worsened around the globe.

U.S. Representatives Willis Hawley and

Reed Smoot: 1930

Although

trade wars still occur, they typically evolve around a few specific products

rather than everything that a country imports.

When these controversies do arise, international organizations, such as

the World Trade Organization (WTO) founded in 1995, try to resolve them before

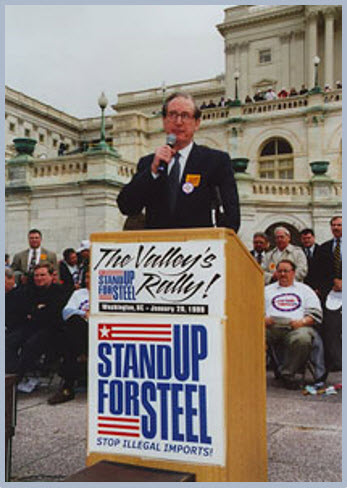

they become destructive. In 2002, the

American steel industry was experiencing difficult times. Plant closings, downsizing and over thirty

declarations of bankruptcy jeopardized local economies and resulted in demands

for government intervention. Steel

manufacturers laid the blame squarely on foreign imports and requested tariffs

on steel from overseas.

Although

some nations were exempt due to trade agreements, the federal government

established tariffs ranging from 8 to 30% on imported steel. Since steel tariffs had traditionally ranged

anywhere from 0 to 1%, these rates seemed extraordinarily high, but steel

producers pointed out these taxes were similar to those placed on shoes and

clothing. The European Union threatened

to retaliate by placing tariffs on American products. With the threat of a trade war looming, the

World Trade Organization investigated the case and ruled against the U.S.

tariff on steel. When President George W.

Bush announced plans to keep the tariff in place in spite of the WTO's

response, the European Union declared it would attach tariffs to oranges from

Florida and autos from Michigan. This was enough to convince the Bush

Administration to disband the tariff in 2003 rather than end it as scheduled in

2005.

Jay

Rockefeller, West Virginia Senator from 1985 to 2015, Speaking at a Steel

Rally: 2002

The

controversy over steel imports and their effect on the U.S. steel industry

heated up again in 2016. American

manufacturers and the Commerce Department accused China and several other

countries of dumping, a practice

that is a form of predatory pricing. It

occurs when one country tries to increase its share of a particular market by

selling goods for less money than it took to produce them. In terms of international trade, this is done

with the intent of driving other nations out of the market. The video listed below explains why dumping

is considered a negative aspect of free trade.

![]() Go to Questions 15 through 20.

Go to Questions 15 through 20.

What's

next?

In

recent decades, the world has experienced a large increase in the volume of

international trade. The number of

preferential trade agreements, which reduce trade barriers among member

nations, has also grown. At the same

time, multinational trade organizations, such as the World Trade Organization

and the World Bank, have expanded their membership and their roles in ensuring

that trade flows smoothly and fairly across the globe. Before learning about these topics in the

next unit, review the names and terms found in Unit 16; then, answer Questions 21

through 30.

![]() Go to Questions 21

through 30.

Go to Questions 21

through 30.

|

| Unit 16 Main Points Worksheet |

| Unit 16 Barriers to Trade Worksheet |

| Unit 16 What is a tariff? An economist explains Article and Quiz |